SK Hynix Inc., the world’s third-largest semiconductor company, announced that it plans to invest more in its chip foundry businesses. Recently, the global chip shortage continues to worsen, causing disruptions in multiple industries and supply chains. The declining chip supply initially started from the automotive sector, rapidly creating ripple effects to other sectors, including consumer electronics.

Commitment to Chip Manufacturing

During the 2021 World IT Show, held at COEX in Seoul, SK Telecom’s President and SK Hynix’s Co-CEO Park Jung-Ho told reporters that the memory chipmaker unit considers expanding its foundry operations. As Park stated, the foundry service expansion would significantly help and improve South Korean fabless companies and chip designers’ technologies. Park also said that the company plans to provide more chip fabrication similar to Taiwan Semiconductor Manufacturing Company’s (TSMC) operations. TSMC is the world’s largest pure-play semiconductor fabrication plant.

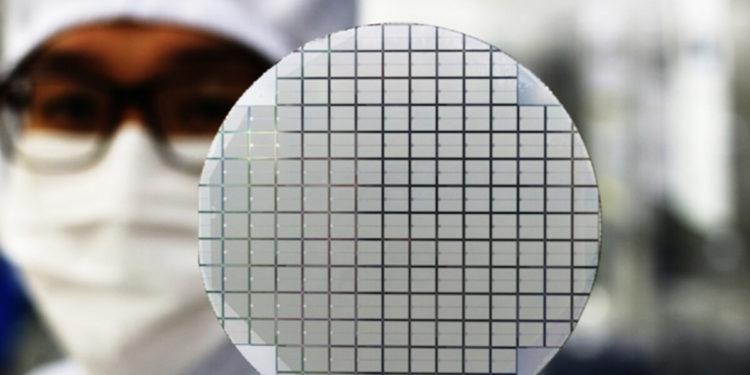

Moreover, SK Hynix would strengthen its foundry businesses through SK Hynix System IC, its semiconductor-manufacturing subsidiary established in 2017. SK Hynix System IC mass-produces chips for electronic equipment, including DDIC chips and CMOS image sensors using 8-inch wafers. Currently, the SK Hynix subsidiary is relocating its production facilities from Cheongju, Korea, to Wuxi, China. Last year, SK Hynix System IC also raised 117.9 billion won ($105 million) in operating income.

SK Hynix also seeks to acquire and partner with other semiconductor firms to boost its foundry operations. In 2020, SK Hynix obtained a 49.8% stake from Magnachip Semiconductor Corp.’s Key Foundry unit through a private equity investment. In 2017, SK Hynix invested 4 trillion won ($3.5 billion) in Japan’s Kioxia, a flash memory chip manufacturer.

Last October, SK Hynix also signed an agreement to acquire Intel’s NAND memory and storage business for 10.3 trillion won ($9.2 million). As part of its long-term growth, SK Hynix CEO Lee Seok-Hee vowed to reinforce its DRAM and NAND global leadership. To this end, the company would social and economic values, employ ESG management strategies and improve shareholder value.

Chip Shortage in South Korea

Furthermore, SK Hynix’s foundry expansion plans stemmed from the chip shortage’s effects on domestic companies. South Korea’s consumer demand for electronics has increased sooner than manufacturers could recover from the pandemic’s impacts. For instance, LG Electronics and Samsung Electronics reduced their home electronics and TV production because of the chip shortage. Smaller companies, including CCTV and medical equipment manufacturers, also struggle to obtain semiconductors due to high prices. Analysts expect the chip supply depletion to last until 2022, continuously increasing chip prices as a result.