Seoul unveils K-Mobility strategy with higher incentives, financing support and autonomous driving goals

South Korea will increase electric vehicle (EV) subsidies by 20% next year, a major push to protect its auto industry from trade pressure and rising global competition. The government confirmed that EV incentives will rise to 936 billion won ($658 million) in 2026, up from 780 billion won this year, with the goal of stimulating domestic demand and speeding up the shift away from gasoline-powered cars.

The announcement was made during the nation’s first Future Car Industry Strategy Dialogue, chaired by Prime Minister Kim Min-seok. During the meeting, officials announced the K-Mobility Global Leadership Strategy — a long-term plan that aims to secure Korea’s position in the next-generation mobility sector.

Four Core Pillars of the K-Mobility Strategy

The strategy focuses on four major policy directions:

- Responding to U.S. tariffs and global protectionism

- Strengthening domestic production and supply chains

- Securing AI-driven autonomous driving technology

- Supporting overseas market expansion for automakers

In addition to consumer subsidies, the government pledged over 15 trillion won ($10.2 billion) in financial support for automakers and parts suppliers in 2026. This will include low-interest loans, extended guarantees and policy finance to help companies transition to future mobility technologies.

Pressure from U.S. Tariffs Intensifies

South Korea’s automotive exports reached $70.8 billion in 2024, accounting for more than 10% of total national exports. However, U.S. tariffs have created significant headwinds for the industry, particularly for Hyundai Motor Group, which earns around 40% of its revenue from the United States.

Initially, U.S. tariffs were set at 25%, heavily affecting Korean automakers. A recent agreement between Washington and Seoul lowered this to 15%, but the new rate has not yet taken effect because both sides have yet to issue an official joint fact sheet. South Korea has urged the U.S. to finalize the agreement quickly.

A government official said Seoul’s priority is to “protect global competitiveness while preparing domestic industries for the next stage of mobility.”

Hyundai and Kia Push Forward Despite Tariffs

Despite facing higher trade barriers, Hyundai and Kia continue to expand their presence in the U.S. market. In the third quarter of 2024, the two brands sold more than 480,000 vehicles, up 12% year-on-year, setting a new quarterly record.

To offset the loss of U.S. federal tax credits, the companies have launched aggressive incentive programs:

- Up to $10,000 EV discounts

- Lease offers as low as $189/month for models such as the Hyundai IONIQ 5

The tariff losses, however, have been substantial. Hyundai reported 1.8 trillion won ($1.2 billion) in losses in Q3 2024 due to tariff-related costs, while Kia recorded 1.2 trillion won ($830 million) in the same period.

Transforming the Auto Supply Chain

A key part of the government’s plan is restructuring the auto parts industry to align with future technologies. By 2030, Seoul aims to convert 70% of internal combustion engine suppliers into “future vehicle corporations.” To achieve this, the government will:

- Designate 200 future vehicle specialist companies

- Launch GX (Green Transition) R&D projects

- Train 70,000 mobility specialists by 2033

An HTC boot camp will also be introduced to improve collaboration between AI, robotics and human workforces, laying the foundation for manufacturing automation and smart factories.

Push Toward Autonomous and AI-Defined Vehicles

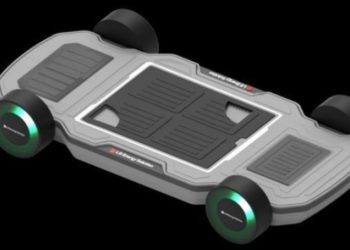

South Korea is collaborating with companies such as LG Electronics and Hyundai Mobis to develop platforms for software-defined and AI-powered vehicles. The goal is to build core technologies that can match the autonomous driving capabilities of the U.S. and China by 2030.

Legislation and regulatory frameworks for autonomous driving are expected to be completed by 2026, followed by city-level demonstrations to test mass deployment in real traffic environments.

Global Market Focus: Beyond U.S.–China Competition

Looking ahead, South Korea aims to diversify its mobility exports and reduce dependence on U.S. and Chinese markets. The government will prioritize seven high-potential countries — including Brazil, India and Saudi Arabia — and launch a 50 billion won innovation fund to support future vehicle technologies.

Officials said the strategy is designed to help Korea “navigate global protectionism while expanding new growth opportunities abroad.” Investment incentives are also being prepared to encourage automakers to expand production both domestically and internationally.