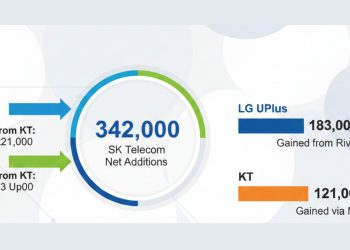

Kakao Corp. shares declined on Friday, underperforming both its peers and the broader market, following news that SK Telecom Co. had sold its entire stake in the South Korean platform giant. SK Telecom offloaded 10,818,510 shares, valued at approximately 413.3 billion won ($278.2 million), based on the previous year’s book value. The sale, conducted through a block deal, came as part of the telecom giant’s broader strategy to secure funding for future investments.

The decision to divest its Kakao shares was made to help SK Telecom raise over 1 trillion won by integrating SK Broadband, its fixed-line and IPTV subsidiary, into a fully owned unit. The funds generated from the sale will also support SK Telecom’s growth initiatives, particularly in areas like artificial intelligence (AI).

Following the news of SK Telecom’s stake sale, Kakao’s shares fell by 3.8%, closing at 37,950 won, underperforming the broader Kospi index, which gained about 1%. The stock dropped to a low of 37,150 won earlier in the day. Foreign investors largely drove the decline, who sold a net 122.4 billion won in Kakao shares. Despite the setback, SK Telecom emphasized that the stake sale would help raise funds for its strategic investments, particularly in artificial intelligence (AI), and to complete its acquisition of SK Broadband.

SK Telecom’s Kakao shares sales have raised 395.2 billion won, a slight difference from the 413.3 billion won expected based on the previous year’s book value. The telecom company intends to use a portion of the proceeds for its planned acquisition of a 24.8% stake in SK Broadband, valued at 1.15 trillion won. The purchase is expected to be finalized by May, following the agreement signed in November with Taekwang Group and Mirae Asset Group, which hold 16.75% and 8.01% of SK Broadband, respectively.

Once SK Telecom completes this acquisition, SK Broadband will become a fully owned subsidiary, strengthening the telecom giant’s position in the fixed-line broadband and IPTV sectors. The company confirmed that, despite the sale, its partnership with Kakao will continue, particularly in areas of technology collaboration.

The company’s plans also include reinvesting the raised funds into AI and other innovative business areas. SK Telecom officials have explained that the decision to sell its Kakao stake comes amid uncertain global economic conditions, making it necessary to secure funds for critical investments.

In October 2019, SK Telecom and Kakao engaged in a stake exchange worth 300 billion won to establish a strategic partnership. Under this arrangement, SK Telecom acquired a 2.5% stake in Kakao, while Kakao gained a 1.6% share in SK Telecom.