January MNP data highlights competitive shifts in South Korea’s mobile market

SK Telecom, South Korea’s largest mobile carrier, added more than 340,000 customers in January through mobile number portability (MNP), as rival KT Corp. temporarily waived early termination fees amid fallout from a major data breach. Industry figures released Monday show that the policy change spurred a sharp increase in subscriber movement toward SK Telecom.

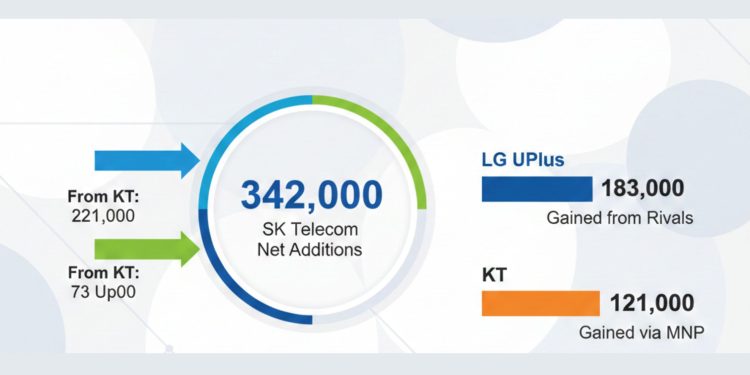

According to data compiled by the Korean Telecommunications Operators Association, a total of 342,000 users switched to SK Telecom last month — an increase of 184.7 percent from December, or about 222,000 more net port-ins.

What Drove the Spike in Switching Activity

MNP allows users to keep their existing phone numbers when moving between carriers — a critical feature in a market where switching costs traditionally include lost number identity and termination fees.

Analysts say the sharp rise in transfers was largely driven by KT’s decision to waive early termination penalties for two weeks starting Dec. 31. The temporary waiver reduced the cost and friction of changing providers, prompting many customers to reconsider their service choices.

Of SK Telecom’s total net additions in January:

- About 221,000 subscribers switched from KT, up sharply from roughly 45,000 in December.

- Around 73,000 came from LG Uplus, the country’s third-largest carrier.

Rival Operators Also See Movement

The MNP surge wasn’t limited to SK Telecom. LG Uplus recorded around 183,000 inbound transfers last month, more than doubling its January activity from the previous month. About 80,000 of those new users came from KT.

KT, for its part, also saw some net inflow through MNP — rising about 53.2 percent month-on-month to roughly 121,000 users in January. However, its outflow was significantly larger, reflecting the impact of the termination fee waiver on subscriber churn.

Data-breach fallout is reshaping the market — and the numbers show it

KT’s temporary fee waiver was offered as part of a compensation package after a data-security incident disclosed in September, which involved unauthorized micropayments and the compromise of subscriber information. That breach damaged customer confidence and drew regulatory scrutiny, including inquiries by South Korean authorities.

Rather than stabilising the base, the waiver substantially lowered the financial and administrative barriers to switching — and many customers took advantage of it. Industry reporting puts the early impact in stark terms: more than 216,000 KT subscribers used the waived-fee window to port out in early January, with the bulk moving to rivals such as SK Telecom and LG Uplus.

Why the waiver triggered such a large outflow can be summarised simply: it converted a reputational problem into a tangible switching opportunity. Three mechanisms help explain the surge:

- Reduced switching cost: With termination fees waived, the direct monetary penalty for leaving disappeared.

- Salvaged inertia: Many customers tolerate minor grievances so long as exit is costly; the waiver removed that inertia.

- Signalling effect: The publicised waiver reinforced perceptions that KT’s incident was serious enough to merit compensation, accelerating distrust.

The scale of the movement also shows how fragile consumer loyalty can be in a mature, high-penetration market like South Korea’s. Even a short, well-publicised policy change can produce outsized churn if it taps into existing unease about security and trust. Analysts say that while short-term port-ins can look like windfall gains for competitors, the episode underlines bigger risks for the industry: once trust is dented, regaining it typically requires sustained, visible measures on security and customer protection.

The current movement follows a turbulent period in South Korea’s telecom market. In 2025, SK Telecom itself suffered a major USIM data breach that exposed sensitive subscriber details and resulted in a substantial regulatory fine. That incident eroded SKT’s market share at the time, allowing competitors to capitalize on customer churn.

The recent reversal — with SKT now gaining subscribers after its rival’s breach — highlights how security failures and trust issues are increasingly influencing customer decisions alongside traditional factors like price and network quality.

What This Means for the Mobile Market

The January spike in MNP activity illustrates how short-term pricing incentives and regulatory responses can reshape subscriber behavior in a mature market. South Korea’s mobile sector is highly competitive, with most consumers already subscribed and carriers fighting for incremental gains.

For SK Telecom, the influx may help stabilize its subscriber base after a challenging year, while also reinforcing its standing as market leader. For KT, the outflow signals deeper reputational challenges that may require more than short-term incentives to address.

Longer-term implications could include renewed focus on customer trust, security investment, and differentiated service offerings as carriers attempt to balance subscriber acquisition with user retention in an increasingly churn-sensitive environment.