SK Telecom and Mirae Asset Securities have announced their partnership that will pursue the expansion of the security token ecosystem in South Korea. SK Telecom, the South Korean Information and communication technology expert, has signed a memorandum of understanding (MOU) with the county’s largest investment banking and stock brokerage company, Mirae Asset Securities to form the Next Finance Initiative.

Next Finance Initiative also known as NFI is a security token consortium formed to encourage the security token sector of the country. Via NFI both partners’ strategies to nurture South Korea’s domestic companies as well as projects who strive to allocate tokens for themselves. The NFI could also be favourable to the nation’s tech-backed economy as it’s highly likely that space for security token-related services will be created as time goes by.

Both companies intend to determine accurate asset coverage with the NFI consortium. The security token-based consortium will also provide a roadmap with rectitude consultation from a strategic and financial perspective.

With the signing of the MOU, SK Telecom and Mirae Asset Securities will put together their expertise gathered over the years in operating various Web3 platforms and investments respectively. Ahn In-seong who’s the current Head of the Mirae Asset Securities digital division remarked that their union with SK Telecom will promote the security token infrastructure across South Korea and at an international level too.

Other than the blockchain industry, SK Telecom has been engaging in the area of wireless telecommunication and internet services. SK Telecom will work as a technology facilitator and assist with its cutting-edge tech outgrowths in the NFI consortium.

Mirae Asset Securities specialize in the finance sector. The company looks forward to prospects to help out budding security token businesses. Furthermore, the South Korean finance specialist is also open to retail investors.

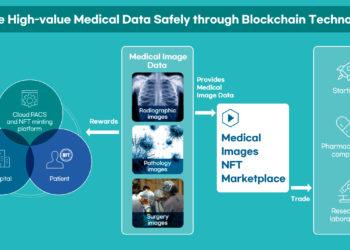

Security tokens work instrumentally in securing real estate, artworks and similar assets. With the enabling of the NFI consortium, individuals will be able to access security tokens over their investments in assets including assets from the entertainment field.

In February this year, the South Korean government introduced its new comprehensive guidelines for blockchain-based tokenized assets. The FSC or financial advice Commission specified how blockchain-based tokens will be seen as securities and be regulated under capital markets rules.

For a while, South Korea has been consulting with legal experts to keep the crypto and blockchain industries in appraisal. It’s mostly a part of the government’s scheme to build dynamic domestic industries and innovations. However, the administration is thorough about the threats so it’s likewise taking a cautious approach with its policies.

The success of the South Korean security token infrastructure model will determine the security token industry’s future in the rest of the world. If things go well for Korea then NFI in cooperation with Mirae Asset Securities could take on the assignment to commercialize security tokens at a global scale.

With the building up of the security token ecosystem in South Korea, there is a good chance of stimulation of Web3 space in the coming years.