New multi-trillion-won investment plans in chips, AI infrastructure and mobility are redrawing South Korea’s industrial map and its role in the global tech race.

In mid-November 2025, South Korea’s biggest conglomerates did something they have not done in years: they all moved in the same direction, at the same time and they moved home.

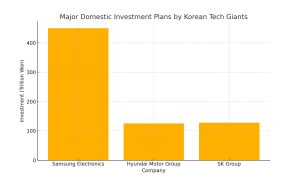

In late 2025, South Korea’s biggest conglomerates quietly redrew the country’s economic future. Within a matter of weeks, Samsung Electronics, Hyundai Motor Group and SK Group pledged a combined 703.2 trillion won (about US$480 billion) in new domestic investments, spanning advanced chip fabs, AI data centres, electric-vehicle plants and “future business” like robotics and software-defined cars.

Within days of a new trade agreement with the United States that lowers U.S. tariffs on Korean cars and locks in a large Korean investment pledge into U.S. industries, the three tech giants each announced huge domestic investment plans.

- Samsung committed 450 trillion won (about US$310 billion) over the next five years in Korea, anchored by an extra semiconductor production line in Pyeongtaek and new AI data centres outside the Seoul region.

- Hyundai Motor Group unveiled a 125.2 trillion won domestic plan for 2026–2030, its biggest local commitment so far, with a strong focus on electrification, software and “future businesses” such as AI-enabled robotics.

- SK Group announced 128 trillion won in domestic capex through 2028, centred on semiconductor manufacturing, AI and related infrastructure.

Taken together, the “big three” alone are pointing over 700 trillion won (more than US$480 billion) at South Korea over the next five to six years. That sits on top of a longer-term 622 trillion won plan by chipmakers to build what the government promotes as the world’s largest semiconductor cluster in Gyeonggi Province by 2047.

This is not just another capex cycle. It is a coordinated attempt to (1) lock in South Korea’s role in the global AI and semiconductor stack, (2) defend high-value manufacturing and jobs at home, and (3) build enough data and computing infrastructure to avoid being squeezed in a more fragmented, protectionist tech world.

The question is less “how big are the numbers?” and more “what does this new wave actually build — and can Korea execute it?”

Who is spending what: a quick map of the mega-plans

Before diving into strategy and risk, it helps to line up the headline commitments.

Major domestic investment plans announced (late 2025)

| Group | Amount (KRW) | Approx. USD | Time frame | Main focus areas in Korea |

| Samsung Electronics | 450 trillion | ~US$310B | 2025–2030 (5 yrs) | New chip line at Pyeongtaek, AI-oriented fabs, AI data centres in South Jeolla & Gumi, ecosystem support for SMEs and startups |

| Hyundai Motor Group | 125.2 trillion | ~US$86–93B | 2026–2030 (5 yrs) | EV production, software-defined vehicles, robotics and physical AI, R&D and plant upgrades |

| SK Group | 128 trillion | ~US$88B | Up to 2028 | AI-driven semiconductor manufacturing, energy and industrial AI, data centre capacity |

These corporate plans sit alongside the state-supported semiconductor mega-cluster plan of 622 trillion won, which bundles long-term investment by Samsung, SK hynix and others into a dense network of fabs and R&D centres around Yongin and wider Gyeonggi.

Rather than a single “national project,” what we see is a stacked landscape: Group-specific capex focusing on each chaebol’s strengths, and a broader government effort to anchor all of that inside a few strategic industrial regions.

Samsung: doubling down on AI chips and regional AI infrastructure

Samsung’s 450 trillion won plan is the anchor for this entire story.

A new production line for the AI era

The most visible piece is the expansion of Samsung’s huge Pyeongtaek complex. The company will add another major semiconductor production line — often referred to as “P5” — targeting ramp-up around 2028. (Reuters)

What it is designed to do:

- Support rising demand for memory and logic chips used in AI servers, advanced PCs and premium smartphones.

- Give Samsung more flexibility between high-bandwidth memory (HBM), DRAM and potentially logic chips as AI workloads evolve.

In parallel with SK hynix, Samsung wants to be at the centre of the AI compute supply chain, supplying the memory that sits next to Nvidia and other AI accelerators. Recent export data show SK Group’s exports expected to exceed 120 trillion won this year on the back of HBM demand, underlining how central AI workloads already are to Korean chip makers.

AI data centres beyond Seoul

The second, less flashy but strategically important piece is Samsung’s plan to build new AI data centres in:

- South Jeolla Province in the southwest, and

- Gumi, an industrial city in North Gyeongsang.

These facilities will host AI compute and storage for government and corporate workloads. Their locations are not accidental:

- They respond to long-standing worries about over-centralisation around Seoul,

- and they tie infrastructure investment to regions that have often lagged in high-tech services.

For Korea’s AI ambitions, this is part of a broader move from just exporting chips to running AI workloads locally — a shift towards “computing sovereignty.”

Hyundai Motor Group: from carmaker to mobility and robotics platform

Hyundai Motor Group’s 125.2 trillion won plan is not only about selling more cars. It is about redefining what a “Korean auto giant” looks like in an electric, software-heavy world.

EVs as a national export engine

Hyundai and Kia already rely heavily on exports from Korean plants. The new trade deal with the U.S., which gradually reduces American tariffs on Korean vehicles, gives them reason to keep some of that production at home rather than shifting everything to North America.

Within the 125.2 trillion won plan:

- A large portion is earmarked for EV and next-generation vehicle production, including expanded capacity in existing plants and new facilities like the dedicated EV plant in Ulsan.

- Another big slice goes into production efficiency upgrades, making Korean plants competitive even as labour and energy costs rise.

Hyundai is effectively betting that Korea can stay a major production base for global EV exports, even as the company also invests in factories in the U.S. and other markets.

Robotics, “physical AI” and software-defined vehicles

The press breakdown of the 125.2 trillion won plan shows around 50.5 trillion won allocated to “future business,” which includes:

- Robotics and physical AI – think factory robots, logistics systems and service robots powered by advanced AI models.

- Autonomous and software-defined vehicles – vehicles where the core value is in software, connectivity and AI functions, rather than just hardware.

This is important for Korea’s wider tech ecosystem:

- It creates demand for domestic AI software, sensing, chips and cloud services.

- It encourages talent flow between manufacturing and IT, rather than treating them as separate worlds.

Over time, Hyundai’s plan could help Korea move from “car exporter” to integrated mobility platform provider, bundling hardware, software, and services.

SK Group: AI chips, exports and the Ulsan “AI power plant”

SK Group’s 128 trillion won domestic investment up to 2028 is, unsurprisingly, focused on semiconductors and AI.

Riding the HBM and AI export wave

SK hynix has become one of the biggest winners of the AI boom, supplying HBM chips used alongside Nvidia GPUs. Group-level export projections show SK expecting more than 120 trillion won in exports this year, for the first time, largely thanks to this AI demand.

The new investment plan continues to:

- Expand semiconductor capacity in Korea, with an emphasis on advanced memory relevant to AI.

- Build supporting capabilities in energy, industrial AI and advanced materials.

The SK–AWS mega data centre in Ulsan

A standout project linked to SK’s broader strategy is the joint AI data centre with Amazon Web Services in Ulsan:

- Total planned investment: about 7 trillion won (US$5.1 billion).

- AWS is expected to fund roughly US$4 billion of that.

- Construction is due to start in late 2025, with full operation targeted by 2029.

The facility is designed to start at around 100 megawatts of capacity, with a path to reach up to 1 gigawatt over time – making it the largest data centre in Korea.

Why it matters:

- It anchors hyperscale AI compute inside Korea, rather than relying entirely on overseas regions.

- It turns Ulsan, traditionally known for heavy industry and shipbuilding, into an AI infrastructure hub, aligning with the government’s wish to spread tech benefits beyond Seoul.

The state’s long game: the semiconductor mega-cluster

While the corporate plans are eye-catching, they plug into a longer-term state strategy.

In early 2024, the government laid out a plan to build what it calls the world’s biggest semiconductor cluster in Gyeonggi Province by 2047.

Key features:

- Combined planned investment of about 622 trillion won by major chipmakers including Samsung and SK hynix.

- A network of up to 16 new fabs plus multiple R&D facilities, with first production and R&D fabs targeted for completion by 2027.

- Targets for millions of direct and indirect jobs over the life of the project.

Alongside this, the government has increased financial support for the chip sector, including low-cost loans and R&D subsidies, as it tries to keep pace with U.S., EU and Chinese industrial policy.

Taken together, the state is not just approving projects; it is co-designing the industrial map that corporate capex will fill.

Why now? Trade deals, tech security and political pressure

The U.S. trade deal as a trigger

The timing of the announcements is not random. They came immediately after a new trade agreement with the U.S., under which:

- South Korea commits to invest about US$350 billion in U.S. strategic sectors over time.

- The U.S. lowers tariffs on Korean vehicles from 25% to 15%, easing some pressure on Hyundai and Kia.

The deal sparked domestic concern that big chaebol would prioritise U.S. plants at the expense of Korean jobs and capacity. In response, President Lee Jae-myung convened major business leaders and pushed for fresh domestic commitments – which quickly arrived.

In that sense, the current wave is both:

- Defensive – keeping political and social support for the trade deal, and

- Offensive – using the window of lower tariffs to elevate Korea as an export and production base for high-value goods.

Tech security and AI geopolitics

The investment plans also sit inside a broader AI and semiconductor arms race.

- U.S. restrictions on exporting top-end AI chips to China have pushed companies like Nvidia to deepen ties with “friendly” markets such as Korea.

- Korea is positioning itself as a trusted partner for AI hardware and infrastructure – a place where global players can build capacity without the same geopolitical risk.

The SK–AWS Ulsan centre, Samsung’s AI data centres in regional cities, and participation in large AI infrastructure projects are all expressions of this strategy.

Domestic politics: “invest at home”

Finally, there is domestic political logic.

- The government has expanded support measures for semiconductors, raising the value of its support package to the industry and promising faster approvals for key facilities.

- The administration is also responding to concerns about regional inequality and youth unemployment. Large factory and data centre projects in areas like Ulsan, South Jeolla and Gumi offer concrete narratives about jobs and opportunity outside Seoul.

For Korea Inc., committing money at home now buys political goodwill, regulatory support and a more stable operating environment at a time of global uncertainty.

The upside: what Korea could gain if it executes well

If these plans are delivered roughly as promised, the potential benefits are significant.

A deeper role in the AI stack

Korea already mattered in memory chips. This investment cycle aims to make it indispensable to the AI stack:

- Upstream: advanced memory and logic from Samsung and SK hynix.

- Midstream: hyperscale AI data centres run with partners like AWS.

- Downstream: AI applications in mobility, robotics, cloud services and manufacturing.

In market terms, Korea is trying to move from “supplier of parts” to “platform country” for AI infrastructure in Asia.

EV and mobility leadership

If Hyundai delivers on its EV and future-mobility projects, Korea can:

- Maintain or grow its share of global vehicle exports,

- Build a stronger domestic ecosystem of battery suppliers, software vendors and component SMEs, and

- Become a reference market for software-defined vehicles and robotisation of factories and logistics.

This is not just about volumes. It is about raising the value-add per car and keeping more of that value inside Korea.

Regional rebalancing – at least on paper

Locating projects in Ulsan, South Jeolla and Gumi gives real weight to regional innovation narratives:

- New data centres and fabs require supporting services – construction, maintenance, networking, local cloud and AI specialists.

- If local universities and colleges align their programmes, these projects can anchor local talent pipelines.

Whether this will be enough to meaningfully narrow regional gaps is an open question, but the physical infrastructure will at least exist.

The risks: execution, cycles and concentration

For all the upside, there are serious risks that KoreaTechToday readers should watch.

Overcapacity and the chip cycle

Semiconductors remain cyclical, even in an AI era.

- If too many fabs are built globally in a short period, and AI demand grows more slowly than expected, margins will be squeezed.

- Korea’s chip mega-cluster and Samsung/SK expansions are happening alongside major investments in the U.S., Taiwan, Japan and China.

The difference now is that AI workloads appear more structural than past PC or smartphone booms – but that does not make them immune to slowdowns or efficiency gains. If expansion overshoots, Korea could face periods of low utilisation and price pressure, even with advanced technology.

Talent bottlenecks

Building and running all this infrastructure requires:

- Semiconductor process engineers,

- AI researchers and ML engineers,

- Data centre operations specialists,

- Power and cooling experts, and more.

Korea already faces competition for such talent between chaebol, startups and global tech firms. Aggressive hiring by Samsung, SK and Hyundai may pull experienced staff away from smaller players, making it harder for startups and SMEs to scale.

At the same time, global partners can help — joint projects with Nvidia, AWS and others may bring in expertise and training – but the domestic skills pipeline still needs to expand.

Energy, land and environmental constraints

High-end fabs and large AI data centres are resource-intensive:

- SK and AWS’s Ulsan centre aims for up to 1 GW of capacity over time, which has major implications for the power grid and local environment.

- Expanding chip fabs in Gyeonggi raises questions around water use, emissions and land use.

Without careful planning, Korea could face:

- Local pushback over energy and environmental costs

- Increased dependence on imported energy if renewable deployment does not keep up

- Regulatory friction that slows or complicates build-outs.

Concentration of power and risk

Finally, the strategy leans heavily on a small number of very large groups.

- If one or more of Samsung, Hyundai or SK are hit by global downturns, trade disputes or governance issues, the national impact is magnified.

- There is also a risk that value remains concentrated inside these groups, with too little spill-over to independent SMEs and startups.

Policy design around procurement, R&D programmes and open ecosystems will decide whether the new infrastructure becomes a shared platform or largely an internal asset for a few conglomerates.

What This Means for Korea’s Tech Ecosystem — and for Asia

The Implications for Korean Startups and Mid-size Tech Firms

The investment wave creates clear opportunities for smaller firms — but also raises new competitive pressures. Demand is rising for specialised software, automation tools, data security, robotics components and battery management systems, especially in supply chains linked to fabs, EV plants and AI data centres. This opens space for niche product development and industry-specific tech solutions.

However, startups now face the challenge of competing for talent with the largest chaebol, which can offer higher salaries and long-term stability. There is also a risk of over-dependence on one or two major corporate customers, which may influence pricing, control direction of product development, and limit a company’s strategic flexibility.

The key for Korean founders will be finding a balance — leveraging the large domestic demand while building technology and business models that are not entirely captive to the chaebol ecosystem.

Korea’s Position in the Asian Competitive Landscape

Regionally, South Korea’s strategy shifts how Asia’s technology map may evolve:

- Taiwan remains the leader in leading-edge logic foundries, but Korea is strengthening its position in memory chips, AI data centres and vertically integrated applications linked to mobility and industrial AI.

- Japan is trying to revive its semiconductor presence with advanced packaging and U.S. partnerships — but Korea is taking a different route: scaling across multiple sectors at once, including EVs, chips, robotics and AI infrastructure.

- China continues to invest heavily in semiconductors and AI, but export controls limit access to high-end technology. This makes Korea increasingly attractive as a “trusted alternative” in global supply chains.

- In Southeast Asia, countries are actively courting data centres and EV manufacturing, yet Korea’s domestic commitments suggest that the highest-value activities — AI modelling, chip design, strategic infrastructure — may remain concentrated in North-East Asia, even if assembly and some services move south.

Overall, Korea is positioning itself not just as a manufacturing base but as a strategic technology hub in the Asia-Pacific region.

Why Global Players Are Paying Attention

For global tech firms — including Nvidia, AWS and other major AI infrastructure providers — Korea now offers a rare combination: (1) A stable regulatory and policy environment, (2) An established industrial base with engineering depth, and (3) Rising domestic demand for high-performance computing and AI services.

This aligns with ongoing supply chain shifts and growing concern over geopolitical risk. As the U.S. maintains restrictions on exports to China, Korea becomes a preferred partner for testing and deploying advanced AI infrastructure across the region.

Rather than simply being a production base, Korea is shaping itself into a platform market — one that global firms can invest in and also work with to develop new AI applications in mobility, manufacturing, cloud services and industrial automation.

Looking to 2030: what to watch

By around 2030, many of today’s announcements will have moved from PowerPoint to the real economy. For KoreaTechToday’s readers, a few metrics will show whether this investment wave has succeeded:

- AI and semiconductor share of exports – does Korea increase its share of the global AI hardware and infra market?

- EV exports and software revenue per vehicle – is Hyundai selling more and earning more per car thanks to software and services?

- Regional employment and income data – do Ulsan, South Jeolla, Gumi and other regions actually narrow the gap with Seoul?

- Startup density around new clusters – do we see independent AI, robotics and component startups thriving around the new fabs and data centres?

The deeper question is simple but important:

Is Korea building the infrastructure for the next phase of global tech growth — or setting itself up for another painful down-cycle?

The honest answer is that both outcomes are possible. What is clear is that the choice is being made now, at home, and at a scale that will shape Korea’s tech landscape for at least a decade.