Proposed deal highlights Kakao’s restructuring drive and Upstage’s push for data and scale

Kakao is pressing ahead with efforts to divest Daum, a move that would mark its exit from a legacy internet business it has managed for more than ten years. The sale centers on AXZ, a fully owned Kakao subsidiary that now runs Daum after the portal was formally separated earlier this year.

According to industry sources, generative AI startup Upstage has emerged as the most likely buyer. People familiar with the discussions said talks have progressed to the point where a broad framework is in place, though the final valuation and transaction details are still being negotiated. If completed, the deal would bring together a first-generation Korean internet platform, Daum, and a fast-growing AI company preparing for an initial public offering.

Stock Swap Likely as Preferred Deal Structure

Rather than a full cash acquisition, industry observers say the transaction is expected to be structured as a stock swap. Given the significant difference in scale between Kakao and Upstage, a share exchange combined with the transfer of management control is viewed as the most realistic option.

A senior IT industry source said the two sides have already aligned on most key terms. “The remaining delay appears to be more about timing the announcement than resolving major disagreements,” the source said, adding that negotiations have been ongoing for several months.

AXZ Operating as Standalone Unit After Spin-Off

Although AXZ remains a 100% Kakao subsidiary in legal terms, it already functions as a standalone operator. AXZ manages all of Daum’s core services, including news, search, shopping, Cafe, email, and the blog platform Tistory, making the business operationally ready for transfer.

Kakao has said it has completed system checks related to the change in Daum’s service provider. “We plan to wrap up the business transfer by the end of the year,” a Kakao representative said, adding that users will be able to continue accessing Daum services through their existing Kakao accounts without disruption.

Divestment Comes After Long-Running Separation Process

For many in the industry, the move does not come as a surprise. Kakao announced plans in May to spin off its portal content operations, later renaming the unit AXZ. Earlier this month, ownership and service operations were formally transferred to the subsidiary.

These steps are widely seen as advance groundwork for a sale, rather than a sudden strategic shift. If the transaction goes through, it would close the chapter on Kakao’s portal business 11 years after it acquired Daum Communications in 2014.

Daum Assets Seen as Key to Upstage’s Expansion Plans

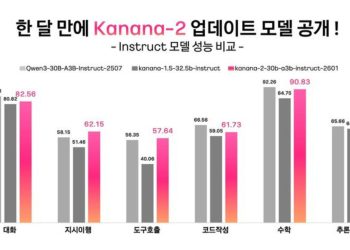

Data access and platform scale are key factors behind Upstage’s interest in Daum. Best known for its SOLAR language model, the company has been exploring ways to extend its AI business beyond enterprise tools and into consumer-facing applications.

Acquiring Daum would provide immediate access to long-accumulated content and user data across news, online communities, email, and blogs. Industry analysts say Daum’s Cafe and mail services are particularly valuable for:

- training large language models

- building retrieval-augmented AI systems

- testing AI services in real-world, high-traffic environments

For Upstage, observers note, Daum may be the fastest way to secure both users and services at scale.

Deal Could Affect Upstage’s IPO Outlook

The deal could also reshape Upstage’s outlook ahead of a planned IPO. The company was valued at around 790 billion won in August 2025, with some market estimates now placing its valuation above 2 trillion won. Bringing a major platform like Daum under its control could strengthen its growth story and shift its positioning from a pure AI technology provider to a broader AI platform company.

While Daum’s influence has declined, it still generated about 332 billion won in revenue last year, providing Upstage with an immediate revenue base alongside data assets.

Kakao Continues Shift Away From Non-Core Businesses

For Kakao, the sale aligns with a broader effort to streamline operations and refocus on core businesses such as AI and KakaoTalk under CEO Chung Shina. The number of Kakao affiliates has already fallen sharply, with further reductions planned.

Daum’s weakening market position has made it less central to Kakao’s future strategy. Its search market share has dropped below 3%, and portal advertising revenue has been declining since peaking in 2021. Against that backdrop, analysts say divesting Daum appears less like a difficult choice and more like an inevitable one.

As negotiations continue, market attention is now focused on when the deal will be formally announced and how ownership and governance will be structured—questions that could shape the future of both South Korea’s AI sector and its legacy internet platforms.