LG Energy Solution, the battery manufacturing unit of South Korea’s LG Group, has signed a long-term contract to receive essential battery materials from Australian Mines Ltd, it said on Monday.

The Deal

Under the deal that will begin in the second half of 2024, LG Energy will continue receiving 71,000 tons of nickel and 7,000 tons of cobalt, expanding over six years.

As per LG Energy, the secure materials will be enough to produce batteries that can power 1.3 million high-performance electric vehicles.

“Securing key raw materials and a responsible battery supply chain has become a critical element in gaining a greater control within the industry. This, due to the increased demand for electric vehicles worldwide in recent years,” said Kim Jong-hyun, the President and CEO of LG Energy Solution.

The demand/prices of the materials grow higher

In 2021, the demand for electric vehicles is as high as ever. As the demand for EVs is soaring, the competition among global battery makers to procure raw materials is fierce. So this deal will help LG Energy Solution a much-needed upper hand in the market.

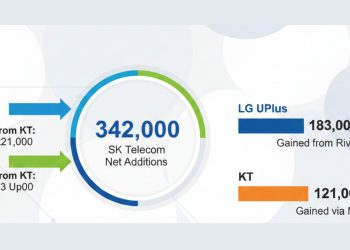

SK Innovation Co., a unit of Korea’s SK Group, has recently signed a deal with Glencore Plc. to buy 30,000 tons of cobalt until 2025.

In Q1, three South Korean companies have captured 31% of the global EV battery market. According to the data by SNE Research, the trio formed by LG Energy Solution, Samsung SDI, and SK Innovation has supplied a combined 47.8 gigawatt-hour (GWh) equivalents of EV batteries in the January-March period, rising 127 percent compared to the year earlier.

Prices of core raw materials such as lithium and cobalt for manufacturing batteries for electric vehicles have risen to a point to threaten the critical future growth engine of the global auto industry.

Raw materials usually account for 30-45% of battery costs, while batteries make up 30-40% of EV prices. Surging raw materials can push up the prices of electric vehicles as well.