Authorities say the change will limit misuse of phone numbers as telecom fraud persists. The rule highlights the tension between fraud prevention and biometric data safeguards.

South Korea’s new SIM registration requirement introduces a fundamental change to how mobile phone numbers are issued and verified. Under the revised rules, individuals seeking to register a new mobile number must complete a real-time facial recognition check as part of the onboarding process. The measure applies regardless of whether the registration is conducted in person or online, and regardless of whether the number is issued through a physical SIM card or an eSIM.

This is not an incremental tightening of paperwork. It is a shift from document-based verification toward biometric confirmation at the point of access to mobile connectivity. The policy makes the SIM card as a regulated digital gateway rather than a simple consumer product.

The new requirement introduces three concrete changes:

- Verification process: A live facial scan is captured and matched against the photograph on an official identification document, with liveness detection to prevent spoofing.

- Scope of application: The rule applies to Korean citizens and foreign residents with valid identification, across telecom carrier stores, authorised resellers, and online registration channels.

- Objective: To ensure that each mobile number can be reliably linked to a single, verifiable individual at the time of issuance.

The stated policy goal is straightforward: eliminate the conditions that allow mass SIM creation, resale of phone numbers to criminal networks, and the use of stolen or leaked personal data to obtain mobile access without the individual’s knowledge.

Importantly, the rule does not affect existing subscribers, nor does it alter how phone numbers are used once issued. Its focus is narrowly placed at the moment a number enters circulation. That narrowness is deliberate. Regulators view the SIM issuance stage as the weakest link in the telecom fraud chain—and the point at which intervention is most effective.

Why the Government Introduced This Rule

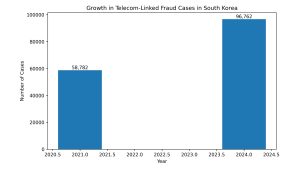

The government’s decision to mandate facial recognition for SIM registration did not emerge in isolation. It was a result of mounting concern over the scale and persistence of telecom-linked crime, which authorities increasingly describe as systemic rather than episodic.

Over the past several years, South Korea has seen a steady escalation in scams that rely on mobile phone numbers as their primary access point. Voice phishing, impersonation of financial institutions, fraudulent investment schemes, and SMS-based attacks have become both more frequent and more sophisticated. Law enforcement agencies note that many of these operations are organised, cross-border, and designed to exploit weaknesses in identity verification processes.

A critical factor behind this escalation has been the availability of illegally registered or misused SIM cards. Criminal groups frequently acquire hundreds or thousands of phone numbers, often registered under stolen or fabricated identities, enabling them to rotate numbers quickly and evade detection. Once a number is flagged, it can be discarded and replaced with minimal cost.

Data breaches have compounded the problem. Large-scale leaks of personal information over recent years made it easier for criminals to register SIM cards using valid credentials without the knowledge of the individuals concerned. In effect, identity theft migrated from financial systems into the telecom layer.

Government officials have consistently framed the facial recognition rule as a response to this structural abuse. Rather than targeting individual users, the policy aims to disrupt the infrastructure that enables telecom fraud at scale.

“By comparing the photo on an identification card with the holder’s actual face on a real-time basis, we can fully prevent the activation of phones registered under a false name using stolen or fabricated IDs”

— South Korea National Police Agency, briefing cited by The Korea Times

Scale of the Problem: Why SIMs Matter

While the policy focuses narrowly on SIM registration, the underlying issue is much broader. Phone numbers now function as critical digital identifiers, anchoring access across multiple layers of the digital economy.

A single mobile number is commonly used to authenticate banking transactions, reset account credentials, access messaging platforms, and verify identity for online services. When a number is compromised, the impact often extends far beyond nuisance calls or messages. It can enable account takeovers, facilitate financial fraud, and allow impersonation of trusted institutions.

Korean authorities have repeatedly emphasised that telecom fraud is no longer marginal or opportunistic. In public briefings, officials have described it as industrialised—relying on scale, automation, and weak points in identity systems.

The SIM card sits at the centre of this problem. Unlike bank accounts or government IDs, phone numbers have historically been easy to obtain, inexpensive, and loosely monitored. As long as that remained true, enforcement efforts downstream—blocking numbers, tracing transactions, prosecuting individuals—were bound to lag behind criminal adaptation.

The facial recognition requirement is designed to address this imbalance by tightening control at the point where digital identities first connect to the telecom network.

The Role of Facial Recognition Technology

Facial recognition was selected after regulators concluded that document-based verification alone could not address the scale of abuse they were confronting. Static identifiers such as ID numbers and photocopied documents had proven vulnerable to theft and reuse, particularly following repeated data breaches.

From a technical perspective, facial recognition offers characteristics that other methods lack. It requires physical presence, enables one-to-one matching between an individual and an official record, and incorporates liveness detection to prevent basic spoofing attempts. These features make bulk or proxy registration significantly more difficult.

Government officials have described the technology as introducing “necessary friction” into a process that had become too permissive. The objective is not convenience or speed, but deterrence—raising the cost and complexity of acquiring phone numbers illegally.

Facial recognition also aligns with broader trends in digital identity management. The technology is already used in border control, smartphone security, and certain financial services. Extending it to SIM registration was therefore framed as an escalation of existing practices rather than an experimental deployment.

However, the choice of biometrics also brings new risks. Facial recognition does not eliminate criminal incentives; it alters the terrain on which they operate. Whether it meaningfully reduces harm or simply displaces it remains a central question for policymakers.

Key Stakeholders and Shifting Responsibilities

The introduction of facial recognition into SIM registration reshapes responsibilities across the telecom ecosystem. While the government mandates the rule, its execution depends heavily on private-sector actors.

Responsibilities are distributed as follows:

- Government and regulators: Set policy requirements, define compliance standards, and oversee enforcement through the Ministry of Science and ICT, law enforcement agencies, and data protection authorities.

- Telecom operators: Integrate biometric verification into onboarding workflows, conduct real-time facial checks, and ensure secure processing during authentication.

- Consumers: Submit biometric data as part of registration and comply with stricter onboarding requirements.

- Foreign residents and visitors: Foreign residents must comply fully, while short-term visitors may experience greater reliance on eSIM providers and alternative access models.

In operational terms, telecom companies rely on existing digital identity platforms already used for banking and public services. This allows the system to function without creating a new centralised government biometric database.

The government has been explicit about the limits of its involvement.

“The government does not collect or store facial recognition data. Biometric information is used solely for real-time verification and is not retained by telecom operators.”

— Ministry of Science and ICT, briefing reported by The Korea Times

Despite these assurances, the policy marks a structural shift. Telecom operators are no longer just connectivity providers; they are becoming intermediaries in identity verification, with new compliance, security, and liability considerations.

Privacy and Data Protection Issues

Facial biometric data occupies a unique position in privacy law. Unlike passwords or identification numbers, biometric identifiers cannot be changed if compromised. Even temporary processing introduces heightened risk.

South Korea has a relatively strong legal framework governing personal and biometric data, and officials have repeatedly emphasised that facial data used in SIM registration is not stored. Nonetheless, critics argue that legal safeguards are only as effective as their enforcement.

Key concerns include the security of real-time processing systems, the potential for unauthorised access, and the broader risk of function creep—where data collected for one purpose gradually becomes acceptable for others. While the current policy limits facial recognition to SIM registration, normalising biometric checks at this level could lower resistance to future expansion.

The credibility of the policy will depend on whether these safeguards remain enforceable as the system scales.

Legal, Ethical, and Social Concerns

The requirement also raises questions about consent and proportionality. Mobile connectivity is essential for participation in modern society, underpinning access to employment, finance, healthcare, and public services. When facial recognition becomes a prerequisite for obtaining a phone number, consent becomes difficult to disentangle from necessity.

Certain groups may face disproportionate burdens, including elderly users, people with disabilities, and individuals with limited digital literacy. Foreign residents and visitors may also encounter additional friction, depending on how the policy is implemented in practice.

From an ethical standpoint, the debate centres on whether a universal biometric requirement is justified by the level of risk posed by telecom fraud. Critics argue that blanket measures risk normalising intrusive verification for the entire population, rather than targeting high-risk cases.

Global Context: How Korea Compares

South Korea’s approach occupies a distinct position internationally. While many countries are grappling with telecom fraud, few have adopted mandatory facial recognition at the SIM registration stage.

- European Union: Strong privacy protections, with facial recognition in routine services heavily restricted.

- United States: Fragmented regulation, with no national biometric requirement for SIM registration.

- India: SIM cards linked to national identity numbers, but facial recognition is not universally mandated.

- China: Extensive use of biometric systems, with limited transparency around data governance.

Korea’s model combines mandatory biometric verification with formal legal limits and private-sector execution. This hybrid approach places it between security-first and rights-based frameworks, making it a closely watched case for other digitally advanced economies.

Will the Policy Work — or Just Shift the Problem?

The effectiveness of facial recognition in SIM registration will ultimately be judged by outcomes, not intent.

Government officials have acknowledged that the policy is not a complete solution.

The Ministry of Science and ICT explained that the measure is designed to reduce the risk of telecom fraud by strengthening identity verification at the point of SIM issuance, though it did not claim the policy would eliminate such crime entirely and indicated it would be monitored during a trial period.

Whether the rule meaningfully reduces harm or simply shifts it elsewhere will depend on enforcement quality, cross-border cooperation, and restraint in expanding biometric requirements.

This Signals for Korea’s Digital Future

South Korea’s decision to introduce facial recognition for SIM registration is a security-first recalibration of digital identity governance. It addresses a real and escalating threat, but it also introduces new responsibilities, risks, and ethical trade-offs.

The policy’s long-term significance lies not only in whether it reduces fraud, but in what it signals about how identity, access, and trust are managed in an increasingly digital society. Clear limits, transparency, and accountability will determine whether biometric verification strengthens public trust—or quietly erodes it.

What is unfolding is not merely a change in telecom procedure, but a test case for how far digital verification should extend in everyday life.