Japan’s spat with Korea is already taking its toll on both economies. SK Hynix, one of Korea’s top chipmakers, has reported a slump on their revenues staring from the second quarter of 2019. The drop has forced the company to take precautionary measures by realigning its resources from producing DRAMs to other products.

Last Friday, the company announced its lowest sales and operating profit since 2016. Their financial report for April to June this year was showed at a significantly lower 6.45 trillion won in sales. This amount is 38 percent lower than last year’s revenue of 10.37 trillion won for the same period.

Their operating profit, on the other hand, also slumped by an eye-watering 89 percent. From 5.57 trillion won in profits, the company only posted 668 billion won this year. This operating profit translated to an operating margin of 10 percent, which is 44 percent lower than last year.

Although the company is mostly going red in its financial statements, the company’s shipment of DRAM chips grew by 13 percent. The contrasting values can be explained by the fall of memory prices in the market. The chips, on average, reported a 24 percent decline in their prices.

NAND Flash, another product of SK Hynix, also reported a 40 percent jump in their shipments. Its price, however, suffered a dizzying 25 percent drop.

What Is Next For SK Hynix?

Some likely realignments in SK Hynix’s production include cutting their DRAM production starting and increasing production in its CMOS image sensor line this fourth quarter. On the other hand, they will increase their NAND production by as much as 50 percent.

A spokesperson explained the decision by saying, “This is to reduce DRAM wafer capacity considering the DRAM demand environment and to strengthen the competitiveness of its CIS business.”

The spokesperson added that while the trade dispute between Japan and Korea is still ongoing, the company plans to stock up on materials necessary for chip production such as etching gas and photoresists.

“As the trade dispute gets fiercer, concerns about memory demand are growing, prompting customers to turn even more conservative,” said the executive vice president of SK Hynix, Cha Jin-Seok.

“If the Japan restrictions prolong, we can’t rule out the possibility of having difficulty in production.”

The Korean-Japan trade war has affected the tech industry the most. The reason for this is that both countries are heavily reliant on tech materials and products each country produces.

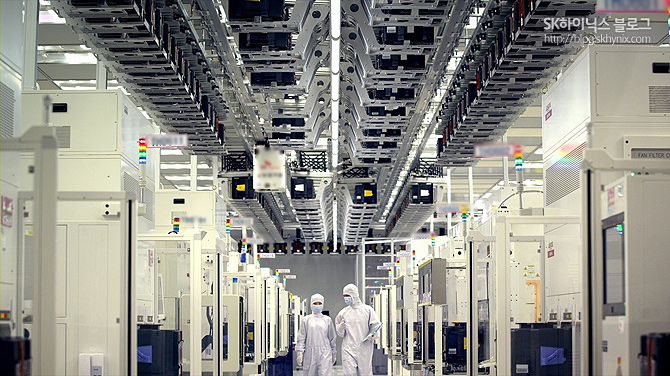

Image grabbed from SK Hynix’s website.