Numerous industry-leading traditional South Korean banks, including Hana, KB Kookmin, Shinhan, and Woori, plan to boost their online platforms. Moody’s Investors Service, an economic research provider and financial services firm, announced in a new report that domestic traditional banking platforms could face increased competition.

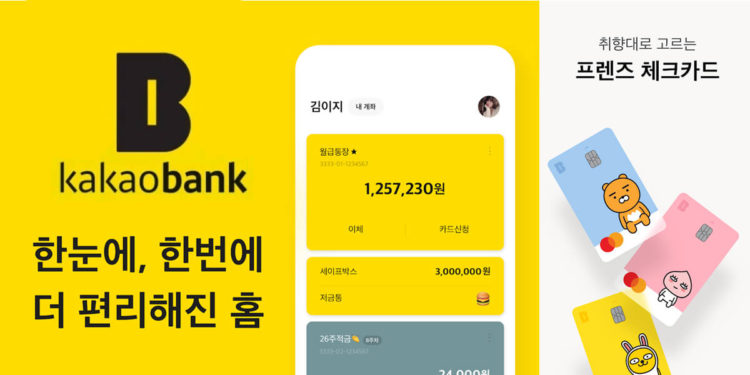

In particular, Moody’s stated that these banks would need to strengthen their online-related operations to catch up with KakaoBank. At present, KakaoBank is the country’s top mobile banking app.

KakaoBank’s Traditional Banking Ventures

Kakao Corp.’s mobile-only banking service is also actively penetrating the core traditional banking markets, including merchant loans and mortgages. Since its launch in 2017, KakaoBank rapidly grew, becoming the eight-largest retail bank in South Korea.

“KakaoBank’s assets rose rapidly in unsecured personal lending by attracting the largest number of users among Korea’s mobile banking apps through a seamless digital banking experience,” said Ok Tae-Jong, Moody’s Vice President and Senior Analyst.

Ok also noted that KakaoBank has lowered costs more than any other local banking institution in 2020. Moreover, the Moody’s official stated that KakaoBank accomplished the feat by utilizing its advanced technologies strategically and operating without physical sites.

Furthermore, KakaoBank’s venture into the highly regulated banking industry contributed to its growth. KakaoBank also plans to ramp up its capital base and loan portfolio. In addition to these financial services, Kakao’s virtual bank unit aims to introduce merchant loan products and mortgages.

Transforming Traditional Banks into Virtual Banks

In the same vein, KakaoBank plans to raise more than 2.6 trillion won in its planned initial public offering (IPO). The online-only bank’s IPO would also pull its shares up in South Korea’s loans market, increasing from 14% to 65%. KakaoBank’s IPO would also price company shares between 33,000 and 39,000.

Moody’s also forecasted that KakaoBank’s IPO could increase its capital to over 76% to 90%. Meanwhile, smaller incumbent banks could experience further reduction and limit their household loans market presence due to KakaoBank’s market dominance.

Moody’s also stated that the local traditional lenders could encounter competitive disadvantages due to their lack of digital platforms. Besides drawing customers, digital banking platforms enable operators to gather information from non-financial services.

As online banking operators continue making inroads into core traditional banking markets, incumbent banks’ digital transition strategies could see increase in costs and operational risks. Fundamental transition risks could also subject traditional banks to more business uncertainties.

Moody’s noted that incumbent banks should expand their online platforms and deliver customer experience similar to online-only banks. Separately, the Naver affiliate Line recently expanded its digital banking platform with Hana Bank across various Asian regions.