KakaoBank Corp., Kakao Corp.’s mobile-only banking service platform, announced that it aims to raise at least 2.6 trillion won ($2.3 billion) in its planned initial public offering (IPO), further increasing the South Korean share-listing boom.

According to its IPO application to the Korea Exchange, KakaoBank plans to sell a total of 65.45 million new shares, pricing them between 33,000 and 39,000 won each. Previously in September 2020, KakaoBank officially shared its plans to list its shares on the country’s main bourse.

If the Internet-only bank hits the top-most results, its market capitalization could reach 15.7 to 18.5 trillion won. KakaoBank’s share listing could also make it the third-largest lender in South Korea, ranking right after KB Financial Group Inc. and Shinhan Financial Group Co.

KakaoBank also chose Credit Suisse Group AG and KB Securities Co. as its share sale’s lead advisers. Additionally, Kakao would begin taking IPO subscriptions from July 26 before officially debuting on August 5.

Booming South Korean IPO Market

The Kakao unit’s IPO is one of the many listings from domestic companies following the e-commerce giant Coupang’s NYSE debut. Other companies from various industries have also been pushing for share listings, including Krafton Inc., a local mobile game publisher.

Moreover, Krafton became the first-ever South Korean decacorn startup to debut in KOSPI, aiming to raise around 5.6 trillion won. Seoul-based analysts also expect Krafton’s IPO to become the country’s biggest share listing for 2021.

Meanwhile, many Kakao affiliates plan to list their shares, including KakaoPay, which already filed for preliminary approval to KOSPI. Investment banking sources also noted that KakaoPay is South Korea’s first digital fintech company to go public.

Besides KakaoPay, Kakao Entertainment announced that it plans to list its shares in the US and domestically. Kakao’s entertainment content subsidiary also prepared for its future IPO by acquiring two US-based storytelling platforms.

Kakao Mobility had reportedly been eyeing a potential IPO, actively monitoring local stock markets as part of the listing. Another Kakao affiliate, the video game content developer Kakao Games, debuted on the KOSDAQ market last year, seeing favorable results.

Becoming a Leading Consumer Choice

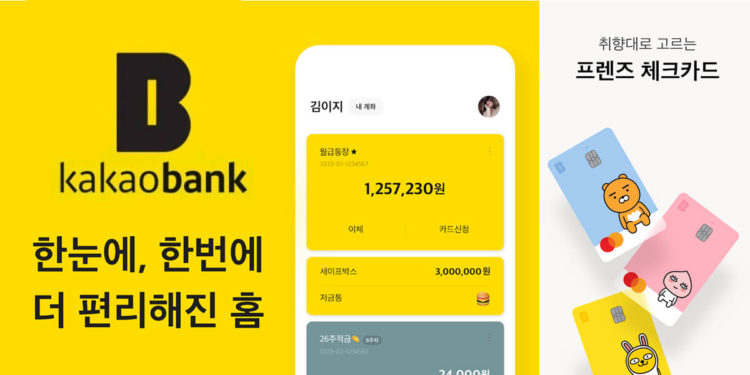

KakaoBank offers full-banking services, including debit cards, deposits, loans, remittances, and more financial amenities through its mobile app. Thanks to its industry-leading parent company, which operates the country’s largest messaging app, KakaoBank experienced rapid business growth.

Since its establishment in 2016, KakaoBank’s customer volume grew to over 14 million as of March this year. The mobile app-based lender’s net users also surpassed one of Korea’s largest commercial lenders KB Kookmin Bank’s numbers.

After examining 18 local banks, the Korea Finance Consumer Federation cherry-picked KakaoBank as the top consumer choice in banking. The study also indicated that KakaoBank improved many business aspects, including friendliness, profitability, and security.